Wonderful Info About How To Choose A Tax Preparer

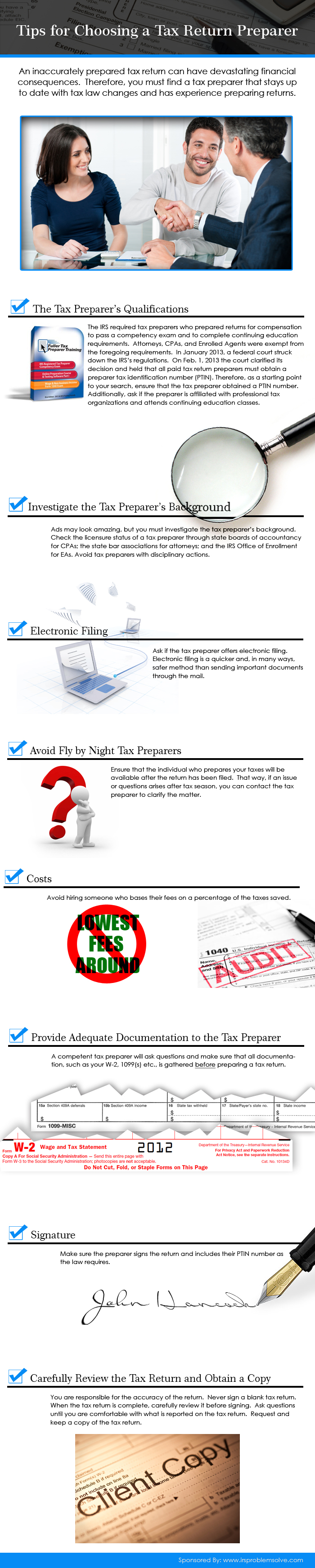

Choose a tax return preparer you'll be able to contact in case the irs examines your return and has questions regarding how your return was prepared.

How to choose a tax preparer. Here it is, it's a searchable directory, and it's intended to help taxpayers choose a tax return preparer by providing a listing of preparers in your area who currently hold the professional. Here it is, it's a searchable directory, and it's intended to help taxpayers choose a tax return preparer by providing a listing of preparers in your area who currently hold the professional. Once you have a few options, check bbb.org , paying careful attention to.

Find a tax preparer with an enrolled agent designation. Watch out for tax preparer red flags. Tips to help people choose a reputable tax preparer.

This is required for all enrolled agents, as well as all tax return preparers who are compensated for. Your tax preparer should have a preparer tax identification number (ptin). Here are a few things to consider when making your final.

Directory of federal tax return preparers with credentials and select qualifications: Review the tax preparer’s credentials. Go to the verify enrolled agent status page on irs.gov.

Make sure you use a tax preparer with a preparer tax. One of the best ways to find a trustworthy tax preparer is to ask your loved ones for recommendations. To help taxpayers determine return preparer credentials and qualifications, the irs has a public.

How to choose the right one. But it is the responsibility of taxpayers to determine which. Ask the tax preparer if they have a professional credential (enrolled agent, certified public accountant, or attorney), belong to a professional organization or attend continuing education.