One Of The Best Info About How To Correct Vat Errors

Simply keep a clear note.

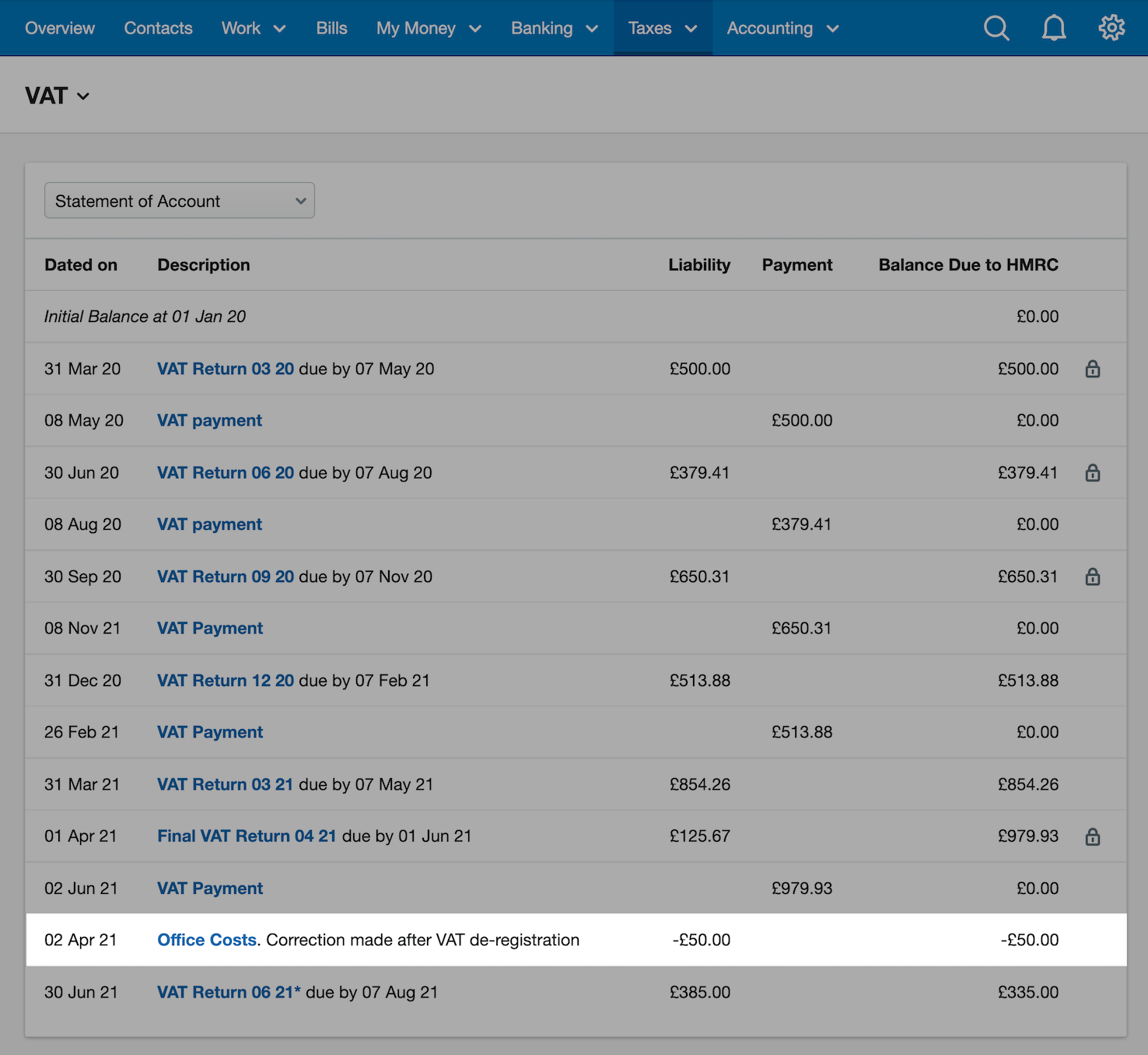

How to correct vat errors. You can correct the error by amending your records. Add up the additional tax due to hmrc If you are running a property related business in dubai, you must need a crm for your real estate business.

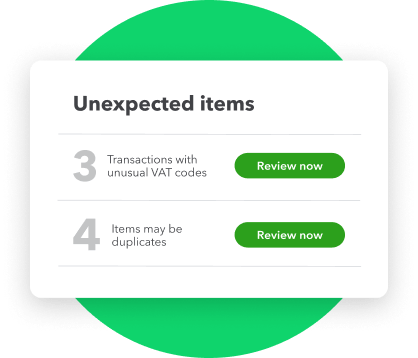

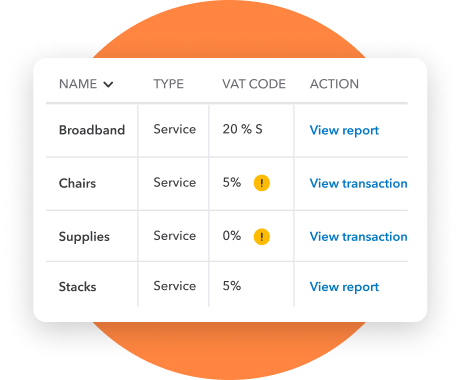

Calculate the net value of errors. A taxpayer needs to check first how much is the effect of the error or omission made to ascertain the approach that he can or should use to. The fta introduced voluntary disclosure form 211 to correct errors or omission committed in filed vat return form 201.

How to correct a vat error? Thank you so much for watching. You can correct the error by amending your records.

A net value of £10,000 (ie: First thing you need to know is, except in cases of tax evasion or non. You have not yet completed your vat account or return for the period in which you made the error.

Correcting vat errors are handled differently depending on whether the mistake exceeds the threshold set by hmrc. Correcting vat errors consists of the two methods described by hmrc in detail. To work out the net value of the errors:

The vat correction limit is: Make sure you share the video with your friends and don’t forget to subscribe. How to correct errors manually?